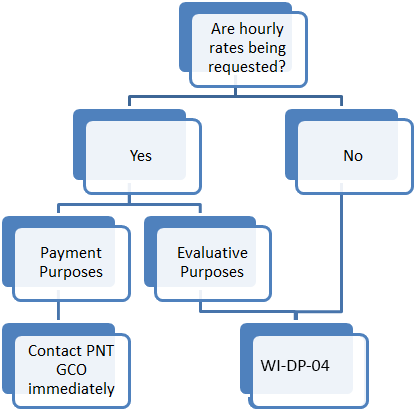

Why is the sponsor requesting hourly rates?

It’s normally because of the sponsor’s practice related to evaluation of the proposal budget in relation to the scope of work. However, for some contract proposals the implications are more serious and can lead to restrictive clauses in the contract, most notably those related to payment.

How is an hourly rate different from a fully loaded/burdened hourly rate?

The primary difference is that an hourly rate is inclusive of salary or direct personnel costs (salary + fringe benefits (ERE)) whereas a fully burdened/loaded rate includes salary + ERE + F&A. A fully burdened rate for graduate research assistants includes salary + ERE + F&A + Tuition. (See Appendix A for examples on calculating hourly and fully burdened rates.)

If the reason for the hourly rates is for evaluative purposes, what should be done?

The proposal should be prepared in accord with the work instruction for Develop Proposal. In addition, the proposal budget narrative should include the disclaimer most relevant for Sponsor requirements. In the event of an award, during project implementation a unit team member will be responsible for calculating number of hours dedicated to project and hourly rates, preparing relevant sponsor required report and certification, and forwarding information to the AMT team member for transmission to sponsor.

What should the disclaimer say?

Federal agencies or pass-through-entity for federal funds

DOD/DOE proposals

“The estimated number of

- hours and/or hourly rates, OR (depending on FOA)

- days and/or daily rates

are provided for evaluation purposes as required in the funding opportunity announcement.”

All others involving federal funds

“The estimates of

- hours and/or hourly rates, OR (depending on FOA)

- days and/or daily rates

are furnished solely for the purpose of this proposal. It is understood that the University will not be required to maintain a record of hours of effort under any resultant award nor required to invoice personnel effort by hours.”

Indefinite quantity contracts

See Appendix A.

Proposals to industry entities (no federal funds involved)

ASU does not provide hourly rates in proposals to Industry sponsors when federal funding is not involved. Per standard practice, proposals to Industry sponsors include total project cost only, i.e., fully-burdened total cost. If Industry Sponsor requests budget details, the total cost per major category (i.e., personnel, equipment, travel, other direct costs) is provided; each category line is fully loaded. Itemized budgets are not provided for proposals for Industry-only funding.

If Industry sponsor requests explanation for personnel line, include the disclaimer

“Rates are composed of salary, fringe benefits, and, if applicable, indirect costs. Profit is not included as Arizona State University is a Public/State Controlled Institution of Higher Education and non-profit entity.

- Salary is based on each individual’s salary level for the current fiscal year as stated in the University’s Capital Management System. Salaries are escalated three percent annually in anticipation of merit raises. Salaries for ‘to be named’ individuals are based on current salary range for the position. In event that salary for the named individual increases significantly, ASU reserves the right to renegotiate hourly rates.

- Fringe benefits are defined as direct costs, estimated as a standard percent of salary applied uniformly to all types sponsored activities, and charged to sponsors in accordance with the Federally-negotiated rates in effect at the time salaries are incurred. Benefit costs are expected to increase approximately 3% per year; the rates used in the proposal budget are based on the current Federally-negotiated Rate Agreement rate plus annual escalation for out years.”

Occasionally a more detailed explanation is requested. Contact the PNT GCO for relevant response.

The FOA says award will be a contract and it has terms and conditions listed, what steps should be taken?

Per Develop Proposal work instruction Create and Route Funding Proposal, the first and most immediate step to take is to contact the PNT GCO. The terms and conditions will have to be reviewed upfront to determine how best to proceed with preparing the proposal. The PNT GCO will provide this guidance.

Are there indicators that the hourly rates requested warrant an early call to PNT?

Yes, watch for any of the following keywords, phrases, and/or FAR clauses:

| Key words and phrases to be wary of | Problematic payment FAR clauses |

|---|---|

| Time and material | 52.216.29 |

| Labor-hour | 52.216-30 |

| Fully loaded/burdened rate | 52.216-31 |

| Labor hour reporting/tracking requirements | 52.232-7 |

| Labor hours fixed for the life of the contract/agreement | 52.243-3 |

| Time card/timesheet information required | 52.246-6 |

| Invoice by number labor hours | |

| Fixed rates | |

| Indefinite delivery/indefinite quantity contact (IDIQ) or indefinite quantity contract (IQC) | |

| Task order under IDIQ/IQC |

If any of these keywords, phrases, and/or far clauses are present, notify PNT GCO for assistance with choosing the appropriate disclaimer which typically will be

“Estimates of number of

- hours and/or hourly rates, OR, (depending on FOA)

- days and/or daily rates

are furnished for this proposal only and for specific personnel only. Estimations of personnel costs measured in hours and rates are determined by a standard method of calculation using the number of hours in the individual’s contract period (nine-month academic or fiscal year, 1560 or 2080, respectively), the individual’s salary stated in the payroll system, fringe benefit costs (employee-related expenses) associated with individual’s job position, and applicable facilities and administrative (indirect) costs. Estimated rates are subject to annual adjustments reflecting changes in salary, standard salary escalation, and/or Federally-negotiated fringe benefit or indirect cost rates. Hourly rates are not auditable in the ASU payroll or financial systems of record.”

Applications to industry related to indefinite quantity contract* (IQC) or task order (to) under IQC

If ASU faculty role in IQC/TO is as a subject matter expert who will be paid as a consultant, follow guidance for “Applications to Industry Sponsors (no Federal funds).” While IQCs and similar contracts are typically funded by Federal pass through funds, the referenced guidance is appropriate.

* Includes similar types of awards, e.g., Indefinite Delivery-Indefinite Quantity, Blanket Purchase Agreements, Multiple Award Contracts.

Applications that will be awarded via firm-fixed price contract or purchase order

Follow guidance for “Applications to Industry Sponsors (no Federal funds),” regardless of funding source.

Appendix A

Examples of method for estimating hourly and fully burdened rates:

Faculty example:

(A) = Salary = $100,000 AY

(B) = % Effort = 25%

(C) = ERE = 30.7%

(D) = F&A = 54.5% for on campus research

(E) = # of Hours in AY = 1560

(F) = # of Hours to be worked = (E) x (B) = 390

Estimated hourly rate =

Salary Requested = (A) x (B) = 25,000

ERE = Salary Requested x (C) = $7,675

Hourly Rate = $25,000 + $7,675 / (F) = $83.78

Estimated fully burdened/loaded rate =

Salary Requested = (A) x (B) = 25,000

ERE = Salary Requested x (C) = $7,675

F&A = ($25,000 + $7,675) x (D) = $17,645

Hourly Rate = ($25,000 + $7,675 + $17,645) / (F) = $129.03

Graduate research assistant example

(A) = Salary = $5,000 Summer

(B) = % Effort = 100%

(C) = ERE = 8.8%

(D) = F&A = 54.5% for on campus research

(E) = Tuition = $941

(F) = # of Hours in Summer = 520

(G) = # of Hours to be worked = (F) x (B) = 520

Estimated hourly rate =

Salary Requested = (A) x (B) = 5,000

ERE = Salary Requested x (C) = $440

Hourly Rate = $5,000 + $440 / (G) = $10. 46

Estimated fully burdened/loaded rate =

Salary Requested = (A) x (B) = 5000

ERE = $5,000 x (C) = $440

F&A = ($ 5,000 + $440) x (D) = $2,938

Tuition = $941

Hourly Rate = ($5,000 + $440 + $2,938 + $941) / (G) = $17.92

Note:

To determine the number of hours in an AY, CY, or summer, see salaries, wages and ERE..

Calculation for faculty member hourly rate uses compensation as stated in payroll system (which may differ from number presented in ERA budget grid).

Calculation for graduate student hourly rate uses salary level as defined by school/college.