Facilities and Administrative (F&A) Costs – Critical for ASU Research

ASU is committed to recovering full F&A costs. These costs are essential to sustaining the university’s research infrastructure.

The Importance of F&A Costs

F&A costs – also known as overhead, administrative allowance, or institutional allowance – are not optional; they are fundamental to supporting ASU’s ability to conduct sponsored research. These costs cover critical expenses that keep research programs operational, including electricity, water, utilities, and administrative research services. Recovering F&A costs is essential to sustaining ASU’s high-quality research enterprise. Without these funds, the university’s ability to support research programs would be compromised, potentially requiring the diversion of resources from other critical areas. Ensuring full recovery of these costs allows ASU to maintain the infrastructure and services necessary for innovative, cutting-edge research.

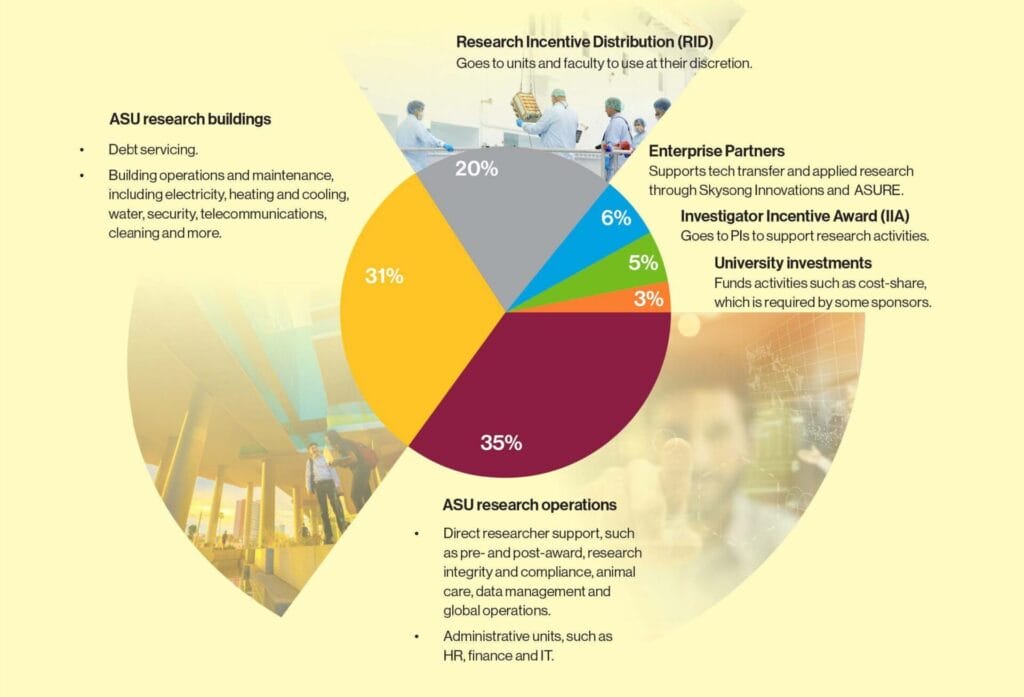

To better understand where these funds go and how they support ASU’s research mission, see the graphic below illustrating the distribution of F&A costs across essential services and infrastructure.

F&A and Direct Costs – Their Roles in Research Funding

F&A costs are shared expenses that benefit multiple projects. These costs are real and unavoidable, and failing to recover them would place an unsustainable financial burden on the university.

Direct costs are assigned to a specific project. These include faculty, technical, and student salaries; Employee-Related Expenses (ERE); travel; scientific supplies; equipment; tuition; human subject incentives; animal costs; and consultant pay.

Fully recovering F&A costs is essential to maintaining ASU’s strong research enterprise. These funds support the infrastructure and services that enable high-quality research. Ensuring the recovery of F&A costs in research activities helps sustain the university’s ability to advance innovation and discovery.